| (6)(7)

| To take action on any other business as may properly come before the 20172020 Annual Meeting or any adjournments or postponements thereof. |

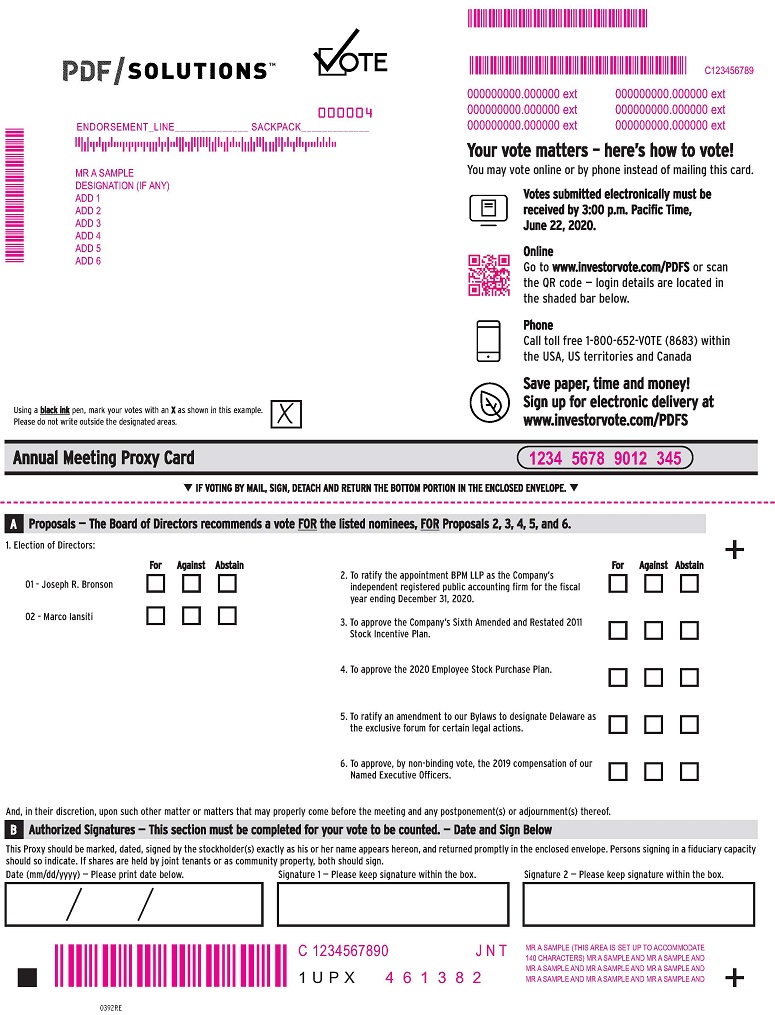

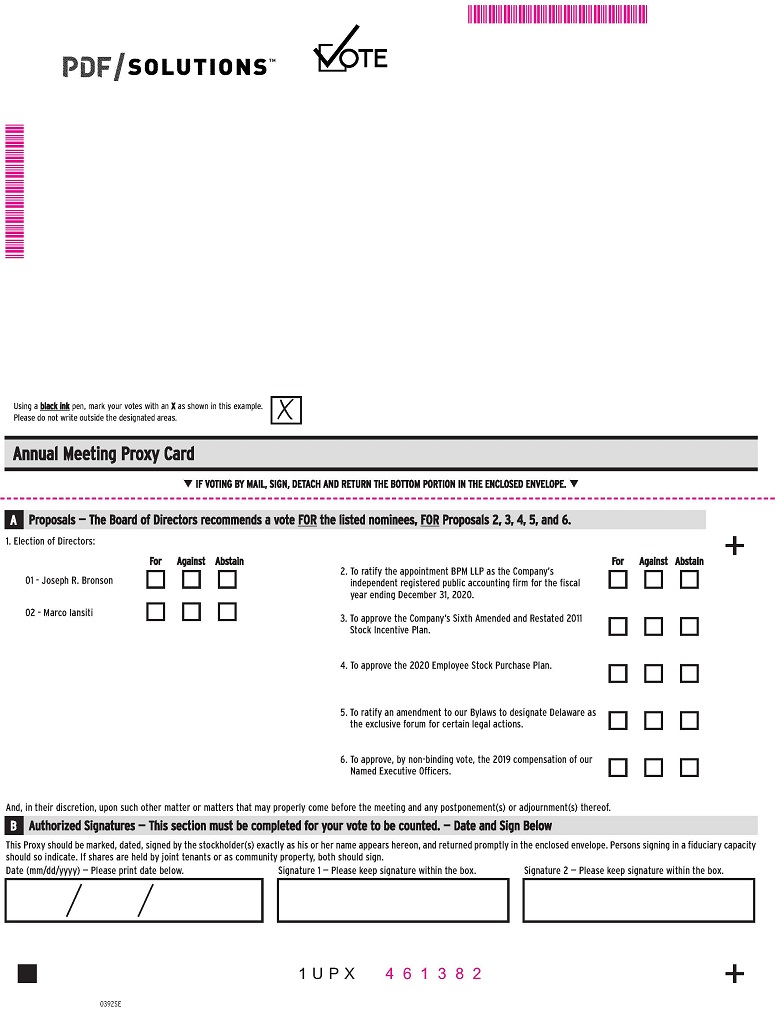

The Board recommends a voteFOR the director nominees, and FOR Proposals 2, 3, 4, 5 and 4, and every1 YEAR for Proposal 5.6. Voting Procedures You may vote by mail.Internet To voteIf you are a stockholder of record, you may submit your proxy by mail, please indicate your preferencesInternet by following the instructions on the enclosed proxy card, date and signNotice or your proxy card and return it inby following the enclosed, postage-prepaid and addressed envelope. If you mark your voting instructions on the proxy card,website.

If you hold your shares will be voted as you have instructed. You may vote in person atstreet name, please check the Annual Meeting.

We will pass out written ballots to any stockholder who attendsNotice or the Annual Meeting in person and requests to vote in person. If your shares are held in “street name” and you wish to vote at the Annual Meeting, you must notifyvoting instructions provided by your broker, banktrustee or other nominee for Internet voting availability and obtain the proper documentation to vote your shares at the Annual Meeting.instructions. Holding shares in “street name” means your shares of stock are held in an account by your stockbroker, bank or other nominee, and the stock certificates and record ownership are not in your name.

You may vote by telephone or via the Internet. If you are a stockholder of record and live in the United States, Puerto Rico, or Canada, you may submit your votes on the proxy by following the “Vote-by-Telephone” instructions on the proxy card. card or the Notice. If you have Internet access,hold your shares in street name, please check the voting instructions provided by your broker, trustee or nominee for telephone voting availability and instructions. You may vote by mail If you may submitrequested and received paper copies of our proxy materials and you are a stockholder of record, and elect to vote by mail, please indicate your preferences on the proxy card, date and sign your proxy from any locationcard and return it in the world by following the “Vote-by-Internet”postage-prepaid and addressed envelope that was enclosed with your proxy materials. If you mark your voting instructions on the proxy card.card, your shares will be voted as you have instructed. Note that you cannot vote by marking the Notice and returning it. The Notice provides instructions on how to vote via the Internet and how to request paper copies of the proxy materials. If you hold your shares in street name, you may vote by mail by completing, signing and dating the voting instruction card provided by your broker, trustee or nominee and mailing it in the accompanying postage-prepaid and addressed envelope. You may vote in person at the Annual Meeting We will pass out written ballots to any stockholder of record who attends the Annual Meeting in person and requests to vote in person. If you hold your shares in street name and you wish to vote at the Annual Meeting, you must notify your broker, bank or other nominee and obtain a legal proxy to vote your shares at the Annual Meeting. You may revoke your proxy.proxy If you are the stockholder of record and you change your mind after you have submitted your proxy via the Internet or by telephone or returned your proxy card, or submitted your proxy by telephone or via the Internet, you may revoke your proxy at any time before the polls close at the Annual Meeting. You may revoke your proxy by: | ● | entering a new vote by telephone, via the Internet, by telephone or by signing and returning another proxy card at a later date, but before the polls close at the Annual Meeting; |

| ● | providing written notice of the revocation before the Annual Meeting to us at PDF Solutions, Inc., Attention: Corporate Secretary, 333 West San Carlos Street, Suite 1000, San Jose,2858 De La Cruz Boulevard, Santa Clara, California, 95110;95050; or |

| ● | voting in person at the Annual Meeting. |

If you hold your shares in street name, you may change your vote by submitting new voting instructions to your broker, trustee or nominee, or, if you have obtained a legal proxy from your broker, bank or other nominee giving you the right to vote your shares, by attending the annual meeting and voting in person. Proxy Solicitation Solicitation of proxies may be made by means of personal calls upon,to, or telephonic, facsimile or electronic communications with, stockholders or their personal representatives by our directors, officers and employees. Our directors, officers and employees will not receive additional remuneration. We will reimburse banks, brokers, custodians, nominees and fiduciaries for their reasonable charges and expenses to forward our proxy materials to the beneficial owners of our common stock. Multiple Proxy Cards If you received more than one proxy card, it means that you hold shares in more than one account. Please sign and return all proxy cards that you have received to ensure that all of your shares are voted. Quorum Requirement Shares are counted as “present” at the Annual Meeting if the stockholder either: | ● | votes in person at the Annual Meeting; or |

| ● | has properly voted via the Internet or by telephone, or submitted a proxy card in the mail ( or voted by telephone or viasomeone has submitted a card on the Internet.stockholder’s behalf).

|

The presence (either in person or by proxy) of a majority of our outstanding shares constitutes the quorum required for holding the Annual Meeting and conducting business. Consequences of Not Returning Your Proxy Card;Voting; Broker Non-Votes If your shares are held in your name, you must return yourvote via the Internet or by telephone, submit a proxy card in the mail, vote by telephone or via the Internet, or attend the Annual Meeting in person, in order to vote on the proposals. If your shares are held in “street name” and you do not vote via the Internet or by telephone, or return your proxyvoting instruction card in the mail, or vote by telephone or via the Internet, your stockbroker may either: | ● | vote your shares on routine matters; or |

| ● | leave your shares unvoted. |

Under the rules that govern brokers who have record ownership of shares that are held in “street name” for their clients, brokers may vote such shares on behalf of their clients with respect to “routine” matters (such as the ratification of auditors), but not with respect to non-routine matters (such as the election of directors or a proposal submitted by a stockholder). IfThe term “broker non-vote” refers to shares that are held of record by a broker for the proposals to be acted uponbenefit of the broker’s clients but that are not voted at the Annual Meeting include both routine andby the broker on non-routine matters because the broker may turn in a proxy card for uninstructeddid not receive instructions from the broker’s clients on how to vote the shares that votes FORand, therefore, was prohibited from voting the routine matters, but expressly states that the broker is not voting on non-routine matters. This is called a “broker non-vote.”shares. Broker non-votes will be counted for the purpose of determining the presence or absence of a quorum, but will not be counted for the purpose of determining the number of votes cast. Because the election of directors is done by a pluralitymajority of the votes cast with respect to a particular director’s election, broker non-votes will not affect the election of directors. We encourage you to provide specific instructions to your stockbroker by returning your proxy cardvoting via the Internet or voting by telephone, or Internet.returning your voting instruction card. This ensures that your shares will be properly voted at the Annual Meeting. Effect of Abstentions Abstentions are counted as shares that are present and entitled to vote for the purposes of determining the presence of a quorum. Accordingly, the effect of an abstention will generally be the same as a vote against a proposal. However, abstentions will have no effect on the election of directors or the advisory vote on the frequency of future advisory votes on the overall compensation of the Company’s named executive officers.directors. Required Vote For Each of the Election of DirectorsProposals Assuming a quorum of stockholders is represented either in person or by proxy at the Annual Meeting, the two nominees receiving the most votes cast will be elected as Class I directors.Meeting: | ● | Each director shall be elected by the vote of a majority of the votes cast with respect to such director. A “majority of the votes cast” means that the number of votes cast “for” a director’s election exceeds the number of votes cast “against” such director’s election (with “abstentions” and “broker non-votes” not counting as either a vote cast “for” or “against” such director’s election). | | ● | Approval of the ratification of the appointment of the independent registered public accounting firm, the Company’s Sixth Amended and Restated 2011 Stock Incentive Plan, the Company's 2020 Employee Stock Purchase Plan, ratification of the amendment to the Company's amended and restated bylaws (our “Bylaws”) to designate Delaware as the exclusive forum for certain legal actions, and the non-binding advisory vote on our executive compensation, each requires the affirmative “FOR” vote of a majority of the shares of common stock present in person or represented by proxy and entitled to vote at the meeting. The vote on approval of our executive compensation is non-binding on the Company and the Board. However, the Compensation Committee, which is responsible for designing and administering the Company’s executive compensation programs, values the opinions expressed by our stockholders and will take the outcome of the vote under advisement in evaluating our executive compensation principles, design and practices. |

Tabulation of the Votes Votes cast by proxy or in person at the Annual Meeting will be tabulated by a representative of Computershare, our transfer agent, and delivered to Rochelle Woodward, our General Counsel. Mrs.Ms. Woodward will act as the Inspector of Elections at the Annual Meeting. The Inspector of Elections also has the responsibility of determining whether a quorum is present at the Annual Meeting. Those shares represented by votes cast via the Internet or by telephone, or represented by proxy cards received, marked, dated, and signed, or represented by votes cast using the telephone or the Internet, and in each case, not revoked, will be voted at the Annual Meeting. If thea stockholder submits proxy card specifies a choicevoting instructions with respect to any matter to be acted on, the shares will be voted in accordance with that specified choice. AnyIf a stockholder of record submits a proxy card which is returned unmarkedbut does not direct how to vote on a particular matter, the individuals named as proxy holders will be votedvote the stockholder’s shares as follows: FOR the director nominees,, FOR Proposals 2, 3, 4, 5, and 4, and every1 YEAR for Proposal 5,6 and in any manner that the proxy holders deem desirable for any other matters that come before the Annual Meeting. Broker non-votes will count as present for purposes of a quorum, but will not be considered as voting with respect to any matter for which the broker does not have voting authority, including the election of a director. We believe that the procedures to be used by the Inspector of Elections to count the votes are consistent with Delaware law concerning voting of shares and determination of a quorum. Publication of Voting Results We will announce preliminary voting results at the Annual Meeting. We will publish the preliminary, or if available, final, voting results in a Current Report on Form 8-K to be filed with the SEC on or before the fourth business day following the date of our Annual Meeting. If not published in an earlier Current Report on Form 8-K, we will publish the final voting results in a Current Report on Form 8-K to be filed with the SEC within four business days after the final voting results are known. You may obtain a copy free of charge from our Internet website atwww.pdf.com, by contacting our Investor Relations Department at (408) 283-5606,938-6491, or through the online EDGAR system atwww.sec.gov. Other Business We do not know of any business to be considered at the Annual Meeting other than the proposals described in this Proxy Statement. However, if any other business is properly presented at the Annual Meeting and if you are a stockholder of record and submit your signed proxy card, givesyou are giving authority to Dr. Kibarian and Mr. WalkerRaza to vote on such matters at their discretion. Proposals for Next Year’s Annual Meeting To have your proposal included in the proxy statement for the 20182021 annual meeting of stockholders, pursuant to Rule 14a-8 under the Securities and Exchange Act of 1934, as amended, you must submit your proposal in writing by the date that is 120 calendar days before the anniversary of the date that this year’s proxy statement is mailedreleased to stockholders. Thus, assuming that this Proxy Statement is mailedreleased to stockholders on or about April 21, 2017,May 8, 2020, your proposal for the 20182021 annual meeting of stockholders should arrive at the Company’s office by December 22, 2017.January 8, 2021. Your proposal should be addressed to us at PDF Solutions, Inc., Attention: Secretary, 333 West San Carlos Street, Suite 1000, San Jose,2858 De La Cruz Blvd., Santa Clara, California 95110. 95050. In addition, our Bylaws provide that a proposal thatin order to nominate one or more potential candidates for election to the Board of Directors or to bring other business before the annual meeting, a stockholder delivers or mailsmust provide timely written notice to our principal executive officesSecretary at the address listed above not less than 90 days and no more than 120 days prior to the one yearone-year anniversary date of this year’s meeting, which will be May 30, 2018June 23, 2021 (the “Anniversary Date”), shall be considered timely received, which means any such proposal would need to be delivered or mailed to us between January 30, 2018February 23, and March 1, 2018.25, 2021. However, our Bylaws also provide that if the date of the annual meeting of stockholders is more than 30 days prior to, or more than 60 days after the Anniversary Date, and less than 60 daysdays’ notice of the date of the meeting is given to stockholders, to be timely received the proposal must be received from the stockholder not later than the close of business on the 10th10th day following the date the meeting date was first publicly announced. If you submit a proposal for the 2018 annual meeting of stockholders after March 1, 2018, or, in the circumstances described above, later than the close of business on the 10th day following the date that 2018 annual meeting of stockholders was first publicly announced,do not provide timely notice, then management has the sole discretion to present the proposal at the meeting, and the proxies for the 20182021 annual meeting of stockholders will confer discretion on the management proxy holders to vote for or against your proposal at their discretion. In the case of nominations to the Board of Directors, such written notice must include certain information about the potential candidate(s) as specified in our Bylaws, and such notice must be accompanied by a completed and signed director questionnaire. In the case of any other business that you propose to bring before the meeting, such written notice must include certain information about such business and certain information about the stockholder and the beneficial owner, if any, on whose behalf the proposal is being made. Please refer to Section 2.5 of our Bylaws for more information. Additionally, a stockholder, or a group of up to 20 stockholders, owning at least 5% of the Company’s outstanding shares of common stock continuously for at least three years, may nominate and include in our proxy statement for the 2021 annual meeting of stockholders, director nominees constituting up to the greater of two nominees or 20% of the board, subject to the requirements specified in our Bylaws. This can be done by providing written notice on Schedule 14N as well as certain other documents and information, as detailed in our Bylaws, to our Secretary at the address listed above not less than 120 days nor more than 150 days before the anniversary of the date that the Company released its proxy statement for the prior year’s annual meeting of stockholders, which for the 2021 Annual Meeting of Stockholders will be no earlier than December 9, 2020 and no later than January 8, 2021. Please refer to Section 2.6 of our Bylaws for more information. | | | | Important Notice of Availability of Proxy Materials for the Annual Meeting of Stockholders to be held on June 23, 2020:

May 30, 2017: Our proxy materials including our Proxy Statement, 20162019 Annual Report on Form 10-K and proxy card are available on the Internet and may be viewed and printed, free of charge, at http:https://ir.pdf.com/sec.cfm. | www.pdf.com/proxy-materials. |

PROPOSAL NO. 1: ELECTION OF CLASS I DIRECTORS The Board of Directors, upon recommendation from the Nominating Committee of the Board of Directors, has nominated two candidates for election to the Board this year as Class I directors, Joseph R. Bronson and Professor Marco Iansiti. Detailed information about each nominee is provided below. Nominees for Class I Directors The Company’s amended and restated bylaws (our “Bylaws”)Bylaws provide that the number of directors shall be established by the Board or the stockholders of the Company. The Company’s amended and restated certificate of incorporation provides that the directors shall be divided into three classes, with each class serving for staggered, three-year terms and one class being elected at each year’s annual meeting of stockholders. The Board has set the number of Directors at six,eight, currently consisting of two Class I directors, twothree Class II directors and twothree Class III directors. One of the Class III director seats is currently vacant. The Class I directors elected at the Annual Meeting will hold office until the first annual meeting that is held after the fiscal year ending December 31, 2019,2022, or until each such director’s successor has been duly elected and qualified. The terms of the Class II and Class III directors will expire at the annual meeting of stockholders next following the fiscal years ending December 31, 2017,2020, and December 31, 2018,2021, respectively. If any director is unable to stand for re-election, the Board may reduce the size of the Board, designate a substitute or leave a vacancy unfilled. If a substitute is designated, proxies voting on the original director candidate will be cast for the substitute candidate. Unless otherwise instructed, the proxy holders will vote the proxies received by them for the Company’s nominee named below. In the event that the Company’s nominee becomes unable or declines to serve as a director at the time of the Annual Meeting, the proxy holders will vote the proxies for any substitute nominee who is designated by the current Board to fill such vacancy. It is not expected that the nominee listed below will be unable or will decline to serve as a director. The Class I nominees listed below are Mr. Bronson and Prof. Iansiti, who each presently serves as a director of the Company andCompany. Each of these nominees has consented to serve a three-year term. Certain individual experience, qualifications, attributes and skills of the below named directors that led the Board to conclude that Mr. Bronson and Prof. Iansiti should be re-nominated, respectively, as directors are described in the biography below. The information below was provided by the nominee and the continuing Class II and Class III directors with unexpired terms. There is no family relationship between the continuing directors, executive officers and the Class I nominees. Nominees for Class I Directors:

Joseph R. Bronson Age | 68

| 71 | | | | Director Since;Since, Class; Leadership | Class

| 2014, Class II; Lead Independent Director | | | | Business Experience and Education | | Mr. Bronson is currently Principal and Chief Executive Officer of The Bronson Group, LLC, which provides financial and operational consulting services, and is a Managing Director and Strategic Advisor to Cowen & Co., a New York City based investment bank. He also serves on the boards of directors of Maxim Integrated Products, Inc., an analog semiconductor company, Jacobs Engineering Group Inc., SDC Materials,a provider of technical, professional and Ryan Herco Flow Solutions.construction services. Prior to his affiliation at Cowen & Co., from May 2011 to March 2014, he was affiliated with GCA Savvian, LLC, as an Advisory Director. From January 2009 to March 2010, Mr. Bronson served as the Chief Executive Officer of Silicon Valley Technology Corporation, a private company that provides technical services to the semiconductor and solar industries. Prior to that, from August 2007 to October 2008, Mr. Bronson served as President and Chief Operating Officer of Sanmina-SCI, a worldwide contract manufacturer, and also served on Sanmina-SCI's board of directors from August 2007 to January 2009. Prior to that, Mr. Bronson served as President and Co-Chief Executive Officer of FormFactor, Inc. from November 2004 to February 2007. Mr. Bronson also served as a senior executive at Applied Materials, Inc. from 1984 through 2004, including as the Chief Financial Officer from 1998 to 2004. Mr. Bronson holds a B.S. in accounting from Fairfield University and an M.B.A. in financial management from The University of Connecticut. |

Board Committee Memberships | | Chair of the Audit and Corporate Governance and Nominating Committees. | | | | Board Committee MembershipsQualifications & Attributes

| Chairman of the Audit and Corporate Governance Committee and member of the Compensation Committee and Nominating Committee.

|

Qualifications &

Attributes

| Mr. Bronson has extensive experience in finance and operations through positions he has held with various companies, including three years as President and Co-Chief Executive Officer of FormFactor, Inc., a manufacturer of advanced semiconductor wafer probe cards, between 2004 and 2007 and 21 years at Applied Materials in senior level operations management, concluding with the positions of Executive Vice President and Chief Financial Officer.Officer, he resigned as Director in November, 2017. Mr. Bronson is also a Certified Public Accountant in the State of New York, a member of the American Institute of Certified Public Accountants and a Series 7 and Series 63 Investment Advisor registered at FINRA. The Board has determined that Mr. Bronson is an “audit committee financial expert” based on his knowledge and understanding of generally accepted accounting principles and financial statements;statements, his experience analyzing and evaluating financial statements that present a breadth and level of complexity of accounting issues relevant to those of the Company;Company, and anhis understanding of internal control over financial reporting. This financial experience is beneficial to the Company and, combined with Mr. Bronson’s extensive knowledge of the industry and operations, enables him to provide valuable strategic input to the Company. |

Marco Iansiti Age | 56

| 58 | | | | Director Since; Since, Class | 2016;

| 2016, Class I | | | | Business Experience and Education | | Professor Marco Iansiti currently serves as the David Sarnoff Professor of Business Administration and heads the Technology and Operations Management Unit and the Digital Initiative at Harvard Business School. Professor Iansiti is also currently the chairman of the board of directors of Keystone Strategy Inc., a consulting firm he co-founded, and a member of the board of directors at Module Q, a private personal resource management application. Previously, from April 2014 through November 2016, he was a member of the board of AltX, a private data platform and marketplace for alternative investments, and from May 2011 to March 2012, Professor Iansiti was a member of the board of Leonardo-Finmeccanica SpA, a global high-tech company in the aerospace, defense, and security sectors, which is publicly listed in Italy. He holds an A.B. and Ph.D. in Physics from Harvard University. | | | | Board Committee Memberships | Chairman

| Chair of the Compensation Committee and member of the Audit and Corporate Governance Committee and Nominating Committee. | | | | Qualifications &

Attributes | | Professor Iansiti has taught at the Harvard Business School for twenty sixtwenty-six years and consulted on strategy, business models, and innovation processes at such global companies as Microsoft, Facebook, IBM, Hewlett Packard, AT&T, Dell, and Amazon, among many others. His broadexperiencebroad experience advising worldwide companies and deep experience in strategy, business models, and technology, including big data analytics,is especially beneficial to the Company as it continues to develop new products and solutions for electrical characterization in expanded markets. |

Continuing Class II Directors: Lucio LanzaKimon W. Michaels, Ph.D.

Age | 72

| 54 |

|

| | Director Since; Since, Class | 1995;

| 1995, Class II |

|

| | Business Experience

and Education | Mr. Lanza is the Managing Director of Lanza techVentures, an early stage venture capital and investment firm, which he founded in January 2001, and the 2014 recipient of the Phil Kaufman Award for Distinguished Contributions to Electronic Design Automation (EDA). Since 2008, he has been a general partner and the chief technology strategist of Radnorwood Capital, LLC, and an investor in public technology companies. Mr. Lanza served as a non-executive director of ARM Holdings PLC from December 2004 to May 2010, and serves on the board of directors of several private companies. From August 2010 to March 2015, Mr. Lanza was a member of the board of Harris & Harris Group, a publicly traded venture capital company. Mr. Lanza received a doctorate in electronic engineering from Politecnico of Milan.

|

Board Committee Memberships

| Chairman of the Board. Chairman of the Nominating Committee and member of the Audit and Corporate Governance Committee and Compensation Committee.

| | | Qualifications &

Attributes

| Mr. Lanza’s extensive operating history in the industry and detailed knowledge of the Company, combined with his experience as a chairman and director of numerous publicly traded and private semiconductor companies, serves the Company well in his role as our Chairman and as a director.

|

Kimon W. Michaels, Ph.D.

Age

| 51

| | | Director Since;

Class

| 1995; Class II

| | | Business Experience

and Education

| Dr. Michaels, one of our founders, has served as our Vice President, Products and Solutions since July 2010.2010, and was designated an Executive Vice President in February 2019. Dr. Michaels served as our Vice President, Design for Manufacturability from June 2007 through June 2010. Prior to that, Dr. Michaels served as our Vice President, Field Operations for Manufacturing Process Solutions from January 2006 through May 2007. From March 1993 through December 2005, he served in various vice presidentialvice-presidential capacities at PDF. He also served as Chief Financial Officer from November 1995 to July 1998. Dr. Michaels received a B.S. in Electrical Engineering, an M.S. E.C.E. and a Ph.D. E.C.E. from Carnegie Mellon University. |

|

| | Board Committee Memberships |

| None |

|

| | Qualifications & Attributes |

| Dr. Michaels provides the Board with unique insight regarding Company-wide issues as an executive of the Company in various leadership capacities and levels of operations, and as a co-founder of the Company. This experience provides the Board with invaluable insight into Company operations. |

Continuing Class III Director:

John Kibarian, Ph.D.Dr. Gerald Z. Yin

Age |

| 76 | | | | Director Since, Class |

| 2018, Class II | | | | Business Experience and Education |

| Dr. Gerald (Zheyao) Yin is currently Chairman and Chief Executive Officer of Advanced Micro-Fabrication Equipment Inc. (AMEC). Dr. Yin also currently serves on the Board of Directors of PDF Solutions Semiconductor Technology (Shanghai) Company Ltd., a wholly-owned subsidiary of PDF Solutions, Inc. Prior to founding AMEC, from 1991 to 2004, Dr. Yin held a variety of executive positions at Applied Materials, including vice president of Asia sourcing and procurement and chief technology officer of Applied Materials Asia. From 1986 to 1991, he led the Etch technology development and introduction initiatives for several key products at Lam Research. Before that, he served in central technology development at Intel Corporation from 1984 to 1986. Dr. Yin received his B.S. in chemical physics from the University of Science and Technology, China. He pursued graduate studies at Beijing University, Department of Chemistry, and received a Ph.D. in physical chemistry from the University of California, Los Angeles. | | | | Board Committee Memberships | | Member of the Compensation and Nominating Committees. | | | | Qualifications & Attributes | | Dr. Yin served as a research group leader at the Chinese Academy of Sciences, where he received two national science team awards. He holds 86 U.S. patents and more than 200 foreign patents. Dr. Yin’s more than 34 years of product development and executive management experience in the semiconductor equipment industry, combined with his experience as chairman of the board of AMEC and his various leadership roles in semiconductor companies, enables him to provide valuable strategic input to the Company. |

Shuo Zhang Age |

| 55 |

|

| | Director Since, Class |

| 2019, Class II |

|

| | Business Experience and Education |

| Ms. Zhang currently serves on the boards of directors at several public and private companies, including S.O.I.TEC Silicon on Insulator Technologies SA, Telink Semiconductor, and Grid Dynamics. She is also actively involved with private venture capital firms in the Silicon Valley. From December 2007 to September 2015, Ms. Zhang served in various senior management capacities at Cypress Semiconductor, including corporate development, general management and worldwide mobile sales. Prior to Cypress, Ms. Zhang served in many different product, marketing and sales management roles at Silicon Light Machines, Agilent Technologies, Altera Corporation, and LSI Corporation. Ms. Zhang holds a B.S. in electrical engineering from Zhejiang University and a M.S. in material science and mechanics from Penn State University. |

|

| | Board Committee Memberships |

| None |

|

| | Qualifications & Attributes |

| Ms. Zhang brings a wide range of relevant experience and expertise in the semiconductor and test industries that is invaluable to the Company’s evolutions to the leading provider of big data solutions for the semiconductor and electronics markets. The Company greatly benefits from her impressive executive track record in sales, marketing, and international mergers and acquisitions, and from her insights and business acumen. |

Continuing Class III Director: Nancy Erba Age | | 53 | | | | Director Since;

Since, Class | 1992;

| 2019, Class III | | | | Business Experience and Education | | Ms. Erba, is currently Chief Financial Officer of Infinera Corporation, since August 2019. She previously served as Chief Financial Officer at Immersion Corporation, a provider of touch feedback technology known as haptics, from September 2016 to March 2019. Prior to that, from November 2003 to October 2015, she served in various capacities at Seagate Technology, a provider of storage solutions, including Vice President of Finance, Corporate Financial Planning and Analysis, Division CFO, Vice President of Business Operations and Vice President of Corporate Development. She is an “audit committee financial expert” based on her knowledge and understanding of generally accepted accounting principles and financial statements, her experience analyzing and evaluating financial statements that present a breadth and level of complexity of accounting issues relevant to those of the Company, and her understanding of internal control over financial reporting. Ms. Erba received her B.S. Degree in mathematics from Smith College and an M.B.A. from Baylor University | | | | Board Committee Memberships | | Member of the Audit and Corporate Governance Committee. | | | | Qualifications & Attributes | | Ms. Erba has an impressive track record of success in building and leading best in class finance, business operations, and corporate development organizations throughout her career, and provides the Board with valuable oversight, direction and strategic input. |

Michael B. Gustafson Age | | 53 | | | | Director Since, Class | | 2018, Class III | | | | Business Experience and Education | | Mr. Gustafson has been Executive Chairman and a member of the Board of Directors of Druva, Inc., a cloud data protection and management company, since April 2016. He is also the sole member of Carve Your Destiny, LLC, a consulting company, and a member of the Board of Directors of Everspin Technologies, Inc. a Nasdaq-listed memory solutions company, Reltio Inc., a cloud-based master data management company, and Matterport, Inc., an immersive 3D media company. From October 2013 to February 2016, he served as Senior Vice President at Western Digital Corporation. Prior to that, he served as Chief Executive Officer and Chairman of Virident Systems, Inc., Senior Vice President and General Manager of File & Content Business at Hitachi Data Systems, Chief Executive Officer and Board Member of BlueArc Corporation, and various executive roles at McData Corporation and was with International Business Machines Corporation early in his career. Mr. Gustafson received his B.S. in Business Administration from Washington University in St. Louis. | | | | Board Committee Memberships | | Member of the Audit and Corporate Governance and the Compensation Committees. | | | | Qualifications & Attributes | | Mr. Gustafson’s more than 25 years as a successful leader of multiple technology companies and teams, including public and private, across infrastructure and software offerings make him a valuable advisor to the Company. |

John Kibarian, Ph.D. Age | | 56 | | | | Director Since, Class | | 1992, Class III | | | | Business Experience and Education | | Dr. Kibarian is one of our founders and has served as our President since November 1991 and our Chief Executive Officer since July 2000. Dr. Kibarian received a B.S. in Electrical Engineering, an M.S. E.C.E. and a Ph.D. E.C.E. from Carnegie Mellon University. | | | | Board Committee Memberships | | None | | | | Qualifications &

Attributes | | Being a leader of the Company since its founding, Dr. Kibarian brings to our Board an extraordinary understanding of our Company’s business, history and organization. Dr. Kibarian’s training and education as an engineer, together with his day-to-day leadership and intimate knowledge of our business and operations, helps the Board in developing and executing the Company’s long-term strategy. |

Vote Required If a quorum is present at the Annual Meeting, the two nominees receiving the highest number of affirmative voteseach nominee will only be elected as a Class I directorsdirector for the three-year term following the Annual Meeting.Meeting if he receives a majority of the votes cast at the Annual Meeting with respect to his election. Unless markedinstructed otherwise, proxies received will be votedFOR the election of the nominees. Recommendation of the Board THE BOARD RECOMMENDS THAT OUR STOCKHOLDERS VOTEFOR THE ELECTION OF THE CLASS I DIRECTOR NOMINEES INDICATED ABOVE. MEETINGS OF THE BOARD OF DIRECTORS AND ATTENDANCE Board Meetings in 20162019 | 9

| 10 | | | | Board Committees | | Audit and Corporate Governance | | | Compensation | | | Nominating | | | | Total Committee Meetings in 20162019 | 12

| 16 (the number of meetings held by each committee is set forth below) | | | | Director Attendance in 20162019 | Each

| All of our Board membermembers attended 75% or more of the meetings of the Board and the committees on which hethey each served, held during the period for which he was a directorthey served as directors or committee member. Atmembers. Five of our 2016directors attended our 2019 annual meeting of stockholders all directors at the time were present either in person or by telephone. All directors are expected to attend the 2017 Annual Meeting. |

BOARD COMMITTEES The following table provides additional information regarding the committees of our Board of Directors during fiscal 2016:2019: Name of Committee and Members | Principal Functions of the Committee | Number of Meetings in Fiscal 2016 2019 | Audit and Corporate Governance Committee Mr. Bronson (Chair) Ms. Erba (as of 6/3/19) Mr. Gustafson Prof. Iansiti (until 6/3/19) | ●

| • Recommends the engagement of the independent registered public accounting firm. | 5

| Governance Committee | ● | • Monitors the effectiveness of our internal and external audit efforts. | | Mr. Bronson (Chair)

| ● | • Monitors and assesses the effectiveness of our financial and accounting organization and the quality of our system of internal accounting controls. | | Prof. Iansiti

| ●

| • Oversees all aspects of the Company’s corporate governance functions on behalf of the Board and makes recommendations on corporate governance issues. | | Mr. Lanza | ●

| Committee charter posted at http://www.pdf.com/ir-governance. | 5 | Compensation Committee | | Prof. Iansiti (Chair) Mr. Gustafson Dr. Yin | | Compensation• Committee

| ●

| Establishes and administers our policies regarding annual executive compensation, including salaries, cash incentives, and long-term equity incentives. | 7

| Prof. Iansiti (Chair)

| ●

| • Assists with the administration of our stock incentive and purchase plans. | | Mr. Bronson

| ●

| Committee charter posted at http://www.pdf.com/ir-governance. | 7 | Mr. Lanza

| | | | | | | | Nominating Committee Mr. Bronson (Chair) Prof. Iansiti Dr. Yin | ●

| •Identifies, reviews and evaluates candidates to serve as directors. | —

| Mr. Lanza (Chair)

| ●

| • Makes other recommendations to the Board regarding affairs related to the directors of the Company. | | Mr. Bronson | ● | Committee charter posted at http://www.pdf.com/ir-governance. | | Prof. Iansiti

| | | 4 |

In addition to the Board and committee meetings noted above, the Board and certain of the committees also acted by unanimous written consent in the conduct of its business. COMPENSATION COMMITTEE As summarized above, and as more fully set forth in the charter to the Compensation Committee approved by the Company’s Board of Directors, the Compensation Committee has the authority to determine the amount and form of compensation paid to the Company’s executive officers, officers, employees, consultants and advisors and to review the performance of such persons in order to determine appropriate compensation, as well as to establish the Company’s general compensation policies and practices and to administer plans and arrangements established pursuant to such policies and practices. The Committee will also periodically review and make recommendations to the Board as to compensation for the non-employee directors of the Board. We have included a more detailed discussion of the Company’s executive compensation program, its objectiveobjectives and the process we undergo to set and review our compensation determinations starting on page 2832 of this Proxy Statement. In addition, page 1214 of this Proxy Statement includes the Compensation Committee’s risk management review of the Company’s compensation policies and practices in fiscal year 20162019 under the heading “Risk Assessment of Compensation Policies.” Each member of the Compensation Committee is an independent director under applicable NASDAQNasdaq listing standards an “outside director” as defined in Section 162(m) of the Internal Revenue Code of 1986, as amended, and a “non-employee director” as defined in Rule 16b-3 under the Securities Exchange Act of 1934 as amended (the “Exchange Act”). The Committee has exclusive authority to determine the amount and form of compensation paid to the Company’s Chief Executive Officer, and to take such action, and to direct the Company to take such action, as is necessary and advisable to compensate the Chief Executive Officer in a manner consistent with its determinations. With respect to “executive officers” (as defined in Rule 3b-7 under the Exchange Act) and “officers” (as defined in Rule 16a-1(f) under the Exchange Act) of the Company, other than the Company’s Chief Executive Officer (“Other Executive Officers”), the Committee has authority to determine the amount and form of compensation paid to the Other Executive Officers, and to take such action, and to direct the Company to take such action, as is necessary and advisable to compensate the Other Executive Officers in a manner consistent with its determinations. Except as set forth below, the Compensation Committee retains and does not delegate any of its power to determine matters of executive and director compensation, although it may from time to time delegate its authority on the matters with regards to non-officer employees and consultants of the Company to our Chief Executive Officer and other appropriate Company supervisory personnel. The Compensation Committee also has authority to select, engage, compensate and terminate compensation consultants, legal counsel and such other advisors as it deems necessary and advisable to assist the Compensation Committee in carrying out its responsibilities and functions as set forth herein. In 2016,2019, the Compensation Committee did not retain any outside compensation consultants. In March 2016,retained the Company engagedservices of Compensia, Inc. (“Compensia”), an independent compensation consultant. The independent consultant to provideprovided the Compensation Committee advice and recommendations on the Company’s stock plan proposal forCompany's peer group, Named Executive Officer compensation, and Lead Independent Director compensation. Compensia provided no other services to the 2016 annual stockholders’ meeting.Company in 2019. NOMINATING COMMITTEE EVALUATION OF BOARD NOMINEES The Nominating Committee identifies nominees by first evaluating the current members of the Board willing to continue in service. If any member of the Board does not wish to continue in service, if the Board decides not to re-nominate a member for re-election or if the Board decides to increase the size of the Board, the Nominating Committee identifies the desired skills and experience of a new nominee in light of the philosophy explained below. Current members of the Nominating Committee are polled for suggestions as to individuals meeting the philosophy of the Nominating Committee. To date,In January and, again, in May, 2019, the Company has notNominating Committee engaged third partiesa third-party search firm, Egon Zehnder International, Inc. (“Egon”), to identify, evaluate or assist in identifying and recommending potential nominees butfor the Company may inpositions on the future retain a third party search firm.Board. Ms. Erba was initially identified and recommended by Egon. Ms. Zhang was initially recommended by Mr. Bronson and then reviewed and recommended by Egon. Once the Nominating Committee has identified a prospective nominee or if it has received a recommendation from a stockholder, the Nominating Committee makes an initial determination as to whether to conduct a full evaluation of the candidate. This initial determination is based on the information provided to the Nominating Committee concerning the prospective candidate, as well as the Nominating Committee’s own knowledge of the prospective candidate, which may be supplemented by inquiries to the person making the recommendation or others. The preliminary determination is based primarily on the need for additional Board members to fill vacancies or expand the size of the Board and the likelihood that the prospective nominee can satisfy the evaluation factors described below. If the Nominating Committee determines, in consultation with other Board members as appropriate, that additional consideration is warranted, it may gather or request the third partythird-party search firm to gather additional information about the prospective nominee’s background and experience. The Nominating Committee then evaluates the prospective nominee, taking into account the following: | ● | the independence of the proposed director within the meaning of the listing standards of The Nasdaq Stock Market; | | | | | | ● | diversity of experience and background of the proposed director, including the need for financial, business, academic, public sector or other expertise on our Board of Directors or its committees; and | | | | | | ● | current composition of the Board, the balance of management and independent directors. |

The Nominating Committee identified increasing diversity at the Board level as an essential element in supporting the attainment of our strategic objectives and its sustainable development. Accordingly, on February 12, 2019, the Board adopted a diversity policy, pursuant to which the Board is committed to actively seeking highly-qualified individuals from minority groups to include in the pool from which new candidates are selected. Candidates will be identified based on merit and suitability and considered against appropriate criteria, having due regard for the benefits of diversity on the Board. In connection with this evaluation, the Nominating Committee determines whether to interview the prospective nominee and, if warranted, one or more members of the Nominating Committee and others, as appropriate, conduct interviews in person or by telephone. After completing this process, the Nominating Committee makes a recommendation to the full Board as to the persons who should be nominated by the Board, and the Board determines the nominees. Professor Iansiti was recommended as a director candidate by our Chief Executive Officer.

Stockholders may send any recommendations for director nominees or other communications to the Board or any individual director in accordance with Section 2.5 of the Bylaws at the following address: Board of Directors (or Nominating Committee, or name of individual director) PDF Solutions, Inc. Attention: Secretary 333 West San Carlos Street, Suite 10002858 De La Cruz Blvd.

San Jose,Santa Clara, California 9511095050

See Proposals for Next Year’s Annual Meeting on page 5 for information on how to recommend or nominate one or more potential candidates for election to the Board of Directors. DIRECTOR INDEPENDENCE The Company has adopted standards for director independence in accordance with NASDAQNasdaq Listing Rules and SEC rules. An “independent director” means a person, other than an officer or employee of the Company or its subsidiaries, or any other individual having a relationship that, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. To be considered independent, the Board must affirmatively determine that neither the director nor an immediate family member has had any direct or indirect material relationship with the Company within the last three years. The Board considered the relationships, transactions or arrangements with each of the directors including relationships and transactions discussed in “Certain Relationships and Related Transactions,” in this Proxy Statement and concluded that none of the current non-employee directors has any relationships with the Company that would impair his independence. The Board has determined that each member of the Board, other than Dr. Kibarian and Dr. Michaels, is an independent director under applicable NASDAQNasdaq Listing Rules and SEC rules. Dr. Kibarian and Dr. Michaels did not meet the independence standards because they are employees of the Company. The Board has determined that: | ● | all directors who serve on the Audit and Corporate Governance, Compensation, and Nominating Committees are independent under the NASDAQNasdaq Listing Rules and SEC rules; and | | | |

| ● | all members of the Audit and Corporate Governance Committee meet the additional independence requirement and they do not directly or indirectly receive compensation from the Company other than their compensation as directors. |

The independent directors meet regularly in executive sessions without the presence of the non-independent directors or members of the Company’s management, and in any event, not less than twice per year during regularly scheduled Board meeting days and from time to time as they deem necessary or appropriate. BOARD LEADERSHIP STRUCTURE AND ROLE IN RISK OVERSIGHT Board Leadership Structure The Company’s Amended and Restated Bylaws, as adopted by the Board has determined that the positions of ChairmanDirectors in April 2019 (the “Bylaws”), provide for a Chairperson of the Board andor, if vacant, a Lead Independent Director. The Bylaws require that the Chairperson position be held by a separate individual from the Chief Executive Officer. Further, no employee may hold the Chairperson position. The Board believes the separation of the Chief Executive Officer should be held by different persons. In addition,and the Chairperson position enhances the Board’s oversight of, and independence from, Company management, the ability of the Board believes thatto carry out its roles and responsibilities on behalf of our stockholders, and our overall corporate governance compared to a combined Chairman/Chief Executive Officer leadership structure. Under the Chairman should not be an employee. Since April 2004, our Chairman has been Lucio L. Lanza. The ChairmanBylaws, the Chairperson of the Board is responsible for coordinating the Board’s activities, including the scheduling of meetings of the full Board, scheduling executive sessions of the non-employee directors and setting relevant items on the agenda (in consultation with the Chief Executive Officer as necessary or appropriate). The Board believes this leadership structure has enhanced the Board’s oversightposition of and independence from, Company management, the abilityChairperson of the Board of Directors has been vacant since May 2018. In January 2019, the independent directors unanimously elected Mr. Joseph Bronson to carry out its rolesthe role of Lead Independent Director. Mr. Bronson has been a director of the Company since May 2014. He currently is Chair of both the Audit and Corporate Governance and Nominating Committees of the Board. Under the Bylaws, in the absence of a Chairperson, the Lead Independent Director may exercise all the rights and powers granted to the Chairperson of the Board. The Lead Independent Director’s primary responsibilities on behalfare set forth in the Lead Independent Director Charter and include presiding at executive sessions of our stockholders, and our overall corporate governance compared to a combined Chairman/the independent directors; calling meetings of the independent directors, as appropriate; serving as liaison between the independent directors and/or the Chief Executive Officer leadership structure.and between the independent directors and senior management; and approving meeting agendas for the Board. The establishment of a Lead Independent Director with robust function, authority and responsibilities reflects the Board’s commitment to strong corporate governance. Board Role in Risk Oversight The Board of Directors plays a significant role in providing oversight of the Company’s management of risk. Senior management has responsibility for the management of risk and reports to the Board regularly with respect to its ongoing enterprise risk management efforts. Because responsibility for the oversight of elements of the Company’s enterprise risk management extends to various committees of the Board, the Board has determined that it, rather than any one of its committees, should retain the primary oversight role for risk management. In exercising its oversight of risk management, the Board has delegated to the Audit and Corporate Governance Committee primary responsibility for the oversight of risk related to the Company’s financial statements and processes and responsibility for the oversight of risk related to the Company’s corporate governance and cybersecurity practices. The Board has delegated to the Compensation Committee primary responsibility for the oversight of risk related to (1) the Company’s compensation policies and practices and (2) administering the Company’s equity compensation plan(s). Each committee reports regularly to the Board with respect to such committee’s particular risk oversight responsibilities. RISK ASSESSMENT OF COMPENSATION POLICIES The Compensation Committee, with the assistance of management, conducted a risk assessment of the Company’s compensation policies and practices in fiscal year 20162019 and concluded that they do not motivate imprudent risk taking. In this regard, the Company notes that: | ● | the Company’s annual incentive compensation is based on balanced performance metrics that promote disciplined progress towards Company goals; | | | | | | ● | the Company does not offer significant short-term incentives that might drive high-risk investments at the expense of long-term Company value; | | | | | | ● | the Company’s long-term incentives do not drive high-risk investments at the expense of long-term Company value; | | | | | | ● | the Company’s compensation programs are weighted towards cash, and the equity component does not promote unnecessary risk taking; and | | | | | | ● | the Company’s compensation is limited to reasonable and sustainable levels, as determined by a review of the Company’s economic position and prospects, as well as the compensation offered by comparable companies. |

The Company’s compensation policies and practices were evaluated to ensure that they do not foster risk taking above the level of risk associated with the Company’s business model. Based on this assessment, the Board concluded that it hasthe Company’s compensation policies and practices do not create risks that are likely to have a balanced pay and performance program that does not promote excessive risk taking.material adverse effect on the Company. CORPORATE GOVERNANCE POLICES The Company provides information on its website about its corporate governance policies, including the Company’s Code of Ethics, which applies to all employees, officers and directors, including the Company’s principal executive officer and principal financial officer, and charters for the three standing committees of the Board (Audit and Corporate Governance, Compensation, and Nominating). and Lead Independent Director Charter. The Board also adopted the following governance policies: Diversity, Corporate Governance Board, Director Confidentiality, and Director Disclosure. These materials can be found atwww.pdf.com under the “Governance” link on the “Investor” tab. The Company’s website address provided is not intended to function as a hyperlink, and the information on the Company’s website is not, and should not be considered, part of this Proxy Statement and is not incorporated by reference herein. Investors may also request free printed copies of the Code of Ethics and committee charters by sending inquiries to us at PDF Solutions, Inc., Attention: Investor Relations, 333 West San Carlos Street, Suite 1000, San Jose,2858 De La Cruz Blvd., Santa Clara, California 95110.95050. The Company’s policies and practices reflect corporate governance initiatives that are compliant with NASDAQNasdaq continued listing requirements and the corporate governance requirements of the Sarbanes-Oxley Act of 2002, including: | ● | a majority of the Board are independent as defined in the NASDAQNasdaq Listing Rule 5605(a)(2); | | | | | | ● | all members of the standing committees of the Board (the Audit and Corporate Governance Committee, the Compensation Committee and the Nominating Committee) are independent as the term is defined under the NASDAQNasdaq Listing Rules; | | | | | | ● | the independent members of the Board meet at least twice per year in execution sessions without the presence of management; | | | | | | ● | the Company has an ethics hotline available to all employees, and the Company’s Audit and Corporate Governance Committee has procedures for the anonymous submission of employee complaints on accounting, internal controls, auditing or other related matters; and | | | | | | ● | the Company has adopted a Code of Ethics that applies to all of its employees, including its principal executive officer and all members of its finance department, including the principal financial officer and principal accounting officer, as well as to members of the BoardBoard. |

Stockholders Communications Our Board welcomes all communications from our stockholders. Stockholders may send communications to the Board or any director of the Board in particular, at the following address: PDF Solutions, Inc., Attention: Investor Relations, 333 West San Carlos Street, Suite 1000, San Jose,2858 De La Cruz Blvd., Santa Clara, California 95110.95050. Any correspondence addressed to the Board or to any one of our directors of the Board sent in care of our corporate offices is reviewed by our Investor Relations department and presented to the Board at its regular meetings. AUDIT AND CORPORATE GOVERNANCE COMMITTEE REPORT The Audit and Corporate Governance Committee of our Board is composed of three independent directors and operates under a written charter adopted by the Board of Directors. The members of the Audit and Corporate Governance Committee are Mr. Bronson (Chair), Prof. Iansiti,Ms. Erba, and Mr. Lanza.Gustafson. Each of the members of the Audit and Corporate Governance Committee is independent as defined by the NASDAQNasdaq Listing Rules. In addition, and based on the background, education, qualification and attributes summarized in this Proxy Statement, our Board has determined that Mr. Bronson qualifiesand Ms. Erba each qualify as an “audit committee financial expert” as defined by SEC rules. Our Board has adopted a written charter for the Audit and Corporate Governance Committee which governs the Audit and Corporate Governance Committee’s functions and responsibilities. The Audit and Corporate Governance Committee reviews and reassesses the adequacy of this charter at least once per year and makes recommendations to the Board regarding changes or amendments the Audit and Corporate Governance Committee deems appropriate. The Audit and Corporate Governance Committee, subject to stockholder ratification, appoints the accounting firm to be engaged as the Company’s independent registered public accounting firm. The independent registered public accounting firm is responsible for performing an independent audit of the Company’s consolidated financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States), or PCAOB, and to issue a report thereon. Management is responsible for our internal controls and the financial reporting process. The Audit and Corporate Governance Committee is responsible for monitoring, overseeing and assessing the effectiveness of these processes. The Audit and Corporate Governance Committee held five meetings during the fiscal year ended December 31, 2016.2019. The meetings were designed to facilitate and encourage communication between the Audit and Corporate Governance Committee, management and our independent registered public accounting firm, PricewaterhouseCoopersBPM LLP. Management represented to the Audit and Corporate Governance Committee that our consolidated financial statements were prepared in accordance with GAAP. The Audit and Corporate Governance Committee reviewed and discussed the audited consolidated financial statements for the fiscal year ended December 31, 2016,2019, with management and the independent registered public accounting firm.firms. The Audit and Corporate Governance Committee discussed with the independent registered public accounting firmfirms the adequacy of the Company’s internal control system, financial reporting procedures and the matters required to be discussed by Auditing Standards No. 16, Communications with the Audit Committees, as adopted byapplicable requirements of the Public Company Accounting Oversight Board.Board and the SEC. The Audit and Corporate Governance Committee has received and reviewed the written disclosures and the letter from the independent registered public accounting firm, PricewaterhouseCoopers LLPfirms as required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent accountant’s communications with the audit committee concerning independence. Additionally, the Audit and Corporate Governance Committee has discussed with PricewaterhouseCoopersBPM LLP, as applicable, the issue of itstheir respective independence from PDF Solutions, Inc. Based on its review of the audited consolidated financial statements and the various discussions noted above, the Audit and Corporate Governance Committee recommended to the Board that the audited consolidated financial statements be included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2016.2019. | THE AUDIT AND CORPORATE GOVERNANCE COMMITTEE OF THE BOARD OF DIRECTORS OF PDF SOLUTIONS, INC.: | | | | Joseph R. Bronson, Chair | | Joseph R. Bronson, Chair

Marco IansitiNancy Erba

| April 11, 201726, 2020 | Lucio L. LanzaMichael B. Gustafson

|

The information contained in the Audit and Corporate Governance Committee Report shall not be deemed to be “soliciting material,” to be “filed” with the SEC, or to be subject to Regulation 14A or Regulation 14C (other than as provided in Item 407 of Regulation S-K) or to the liabilities of Section 18 of the Exchange Act and, notwithstanding anything to the contrary set forth in any of the Company’s filings under the Securities Act of 1933 or the Exchange Act that might incorporate future filings, including this Proxy Statement, in whole or in part, the Audit and Corporate Governance Committee Report shall not be deemed to be incorporated by reference into any such filings with the SEC except to the extent that the Company specifically incorporates it by reference into a document filed under the Securities Act of 1933 or the Exchange Act. PROPOSAL NO. 2: RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM The Audit and Corporate Governance Committee has appointed PricewaterhouseCoopersBPM LLP (“PwC”BPM”) as our independent registered public accounting firm for the fiscal year ending December 31, 2017.2020. In the event that ratification of this selection of auditors is not approved by a majority of the shares of common stock voting at the Annual Meeting in person or by proxy, the Audit and Corporate Governance Committee will consider interviewing other independent registered public accounting firms. There can be no assurances, however, that it will appoint another firm if this proposal is not approved. Even if the selection is ratified, the Audit and Corporate Governance Committee in its discretion may select a different registered public accounting firm at any time to be the independent registered public accounting firm for the fiscal year ending December 31, 2017,2020, if it determines that such a change would be in the best interests of the Company and our stockholders. BPM was retained by us on September 13, 2018, as announced in our Current Report on Form 8-K, filed on September 13, 2018. Previously PricewaterhouseCoopers LLP (“PwC”) acted as our independent registered public accounting firm before being dismissed by the Audit Committee on September 13, 2018. The report of PwC on the Company’s consolidated financial statements for the fiscal year ended December 31, 2017 and 2016 and for each of the two years in the period ended December 31, 2017 did not contain an adverse opinion or disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope or accounting principles. In connection with the audits of the Company’s consolidated financial statements for the fiscal years ended December 31, 2017 and 2016, and in the subsequent interim period through September 13, 2018, there were no disagreements with PwC on any matters of accounting principles or practices, financial statement disclosure or auditing scope and procedures which, if not resolved to the satisfaction of PwC, would have caused PwC to make reference to the matter in their report. There were no reportable events (as that term is described in Item 304(a)(1)(v) of Regulation S-K) during the two fiscal years ended December 31, 2017 and 2016, or in the subsequent period through September 13, 2018. A representative of PwCBPM is expected to be present at the Annual Meeting. This representative will have an opportunity to make a statement and will be available to respond to questions. Principal Accountant Fees and Services The table below shows the fees for professional services rendered by PricewaterhouseCoopers LLPBPM was our independent registered public accounting firm for the audit of our financial statements for 2016quarterly period ended September 30, 2018, and 2015,the years ended December 31, 2019 and 2018. The aggregate fees billed for other services rendered by PwC for those periods: BPM’s audits of our 2019 and 2018 financial statements are summarized in the following service categories:

Fee Category | | Fiscal 2016 Fees | | | Fiscal 2015 Fees | | Audit Fees (1) | | $ | 968,840 | | | $ | 1,009,500 | | Audit-Related Fees (2) | | $ | — | | | $ | 80,000 | | All Other Fees | | | — | | | | — | | Total Fees | | $ | 968,840 | | | $ | 1,089,500 | |

Fees Billed to the Company | | 2019 | | | 2018 | | Audit fees(1) | | $ | 720,636 | | | $ | 642,150 | | Audit related fees | | | — | | | | — | | Tax fees | | | — | | | | — | | All other fees | | | — | | | | — | | Total Fees | | $ | 720,636 | | | $ | 642,150 | |

| | | | | (1) | Represents the aggregateIncludes fees for professionalaudit services rendered for the audit of our annual financial statements included in our annual report on Form 10-K, review of financial statements included in our quarterly reports on Form 10-Q and services that were provided in connection with the annual audit of financial statements, internal controls over financial reporting,statutory and statutory audit.

| | (2)

| Fees related to acquisition due diligence.regulatory filings or engagements.

|

Policy on Audit and Corporate Governance Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Registered Public Accounting Firm The Audit and Corporate Governance Committee’s policy is to pre-approve all audit and permissible non-audit services provided by PwC.BPM. These services may include audit services, audit-related services, tax services and other services. Pre-approvalPreapproval is generally provided for up to one year and any pre-approval is detailed as to the particular service or category of services and is generally subject to an initial estimated budget. PwCBPM and Company management are required to periodically report to the Audit and Corporate Governance Committee regarding the extent of services provided by PwCBPM in accordance with this pre-approval, and the fees performed to date. The Audit and Corporate Governance Committee may also pre-approve particular services on a case-by-case basis. All services provided by PwCBPM during the fiscal years ended December 31, 20152018 and 2016,2019, were approved by the Audit and Corporate Governance Committee in accordance with our pre-approval policy and applicable SEC regulations. Required Vote So long as a quorum is present (in person or by proxy) at the Annual Meeting, a majority of the votes cast at the Annual Meeting is required to approve this proposal. Unless otherwise instructed, the proxy holders will vote the proxies they receiveFOR the ratification of PriceWaterhouseCoopersBPM LLP as Company’s independent registered public accounting firm, as disclosed in this Proxy Statement. Recommendation of the Board THE BOARD RECOMMENDS THAT OUR STOCKHOLDERS VOTEFOR THE RATIFICATION OFPRICEWATERHOUSECOOPERS BPM LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTINGFIRM FOR THE YEAR ENDING DECEMBER 31, 2017.2020. PROPOSAL NO. 3: APPROVAL OF THE FOURTHSIXTH AMENDED AND RESTATED 2011 STOCK INCENTIVE PLAN At our 2011the 2020 Annual Meeting, of Stockholders,we are asking our stockholders to approve the stockholders approved the Company’s 2011 Stock Incentive Plan. The number of shares initially reserved for future awards under theSixth Amended and Restated 2011 Stock Incentive Plan was 3,200,000. At(the “Sixth Amended 2011 Plan”), which is the 2013 Annual Meeting, our stockholders approvedsixth amendment and restatement of the First Amended and Restated 2011 Stock Incentive Plan to increase the number of shares reserved for awards under it toby an additional 1,250,000 shares for a total of 4,800,00011,550,000 shares, which was an increaseand to extend the term of an additional 1,600,000 shares. At the 2014 Annual Meeting, our stockholdersplan by 10 years from the date of stockholder approval. Stockholders originally approved the Second Amended and RestatedCompany’s 2011 Stock Incentive Plan at our 2011 Annual Meeting, with 3,200,000 shares initially reserved for future awards under it. Stockholders have approved five prior amendment and restatements to the 2011 Stock Incentive Plan to, among other things, increase the number of shares reserved for awards under it to a totalas follows: | ● | an additional 1,600,000 shares at the 2013 annual meeting of 6,550,000 shares, which was an increase of an additional 1,750,000 shares. At the 2016 Annual Meeting, our stockholders, for a total of 4,800,000 shares reserved; | | ● | an additional 1,750,000 shares at the 2014 annual meeting of stockholders, for a total of 6,550,000 shares reserved; | | ● | an additional 1,250,000 shares at the 2016 annual meeting of stockholders, for a total of 7,80,000 shares reserved; | | ● | an additional 1,250,000 shares at the 2017 annual meeting of stockholders, for a total of 9,050,000 shares reserved; and, | | ● | an additional 1,250,000 shares at the 2019 annual meeting of stockholders, for a total of 10,300,000 shares reserved. |

If this proposal is not approved, the ThirdFifth Amended and Restated 2011 Stock Incentive Plan (the “Third“Fifth Amended 2011 Plan”) to increase the number of shares reserved for awards under it to a total of 7,800,000 shares, which was an increase of an additional 1,250,000 shares. The Third Amended 2011 Plan took effect on May 31, 2016, and will continue in effect through May 30, 2026, if this proposal is not approved.27, 2029. At the 2017 Annual Meeting, we are asking our stockholders to approve the Fourth Amended and Restated 2011 Stock Incentive Plan (the “Fourth Amended 2011 Plan”) to increase the number of shares reserved for awards under it to a total of 9,050,000 shares, which is an increase of an additional 1,250,000 shares. As of April 3, 2017,17, 2020, there were 2,059,1982,433,478 shares subject to outstanding grants and 3,522,2263,373,718 shares remaining available for future grants under the ThirdFifth Amended 2011 Plan. The FourthSixth Amended 2011 Plan would result in 4,772,2264,623,718 shares being available for future awards based on the shares available for future awards under the ThirdFifth Amended 2011 Plan as of April 3, 2017. 17, 2020.

If approved by our stockholders, the FourthSixth Amended 2011 Plan will take effect on May 30, 2017,June 23, 2020, and will continue through May 29, 2027.June 22, 2030. On April 11, 2017, ourOur Board of Directors adopted the FourthSixth Amended 2011 Plan on April 26, 2020, subject to the approval of the stockholders. The Board of Directors believes that the number of shares currently available for future awards is inadequate to achieve the purpose of the plan, which is to attract and retain the best possible individuals to promote our success. The FourthSixth Amended 2011 Plan is identical to the ThirdFifth Amended 2011 Plan other than with respect to the increase in reserved shares and the extension toof the term. The Board of Directors believes that the ability to continue to distribute equity awards under the FourthSixth Amended 2011 Plan is important for our continued growth and success.

As of April 3, 2016, the fair market value of a share of Company common stock (based on the closing price of the Company’s common stock) was $22.55.

Promotion of Good Corporate Governance Practices The FourthSixth Amended 2011 Plan was designed to include a number of best practice provisions that we believe reinforce the alignment between our stockholders’ interests and equity compensation arrangements for employees, non-employee directors and contractors. These provisions include, but are not limited to the following: ✓ | Double-trigger vesting of awards upon a change in control | x | No “evergreen” provision | ✓ | Awards are subject to clawback | x | No repricing of stock options or stock appreciation rights without shareholder approval | ✓ | Focus on performance-based equity awards to align with Company performance | x | No discount options or stock appreciation rights | ✓ | Individual share limits for all participants | x | No “liberal share recycling” | ✓ | Separate share limits for non-employee directors | x | No liberal “change in control” definition | ✓ | Fungible share reserve to manage dilution | x | No “reload” equity awards | | | x | No transferability except by will or unless approved by the Board or the Plan administrator |

| ● | No Evergreen Provision. There is no “evergreen” feature providing for the annual replenishment shares of reserved for issuance under the FourthSixth Amended 2011 Plan. |

| | | | ● | No Repricing Without Stockholder Approval. The FourthSixth Amended 2011 Plan does not authorize, without stockholder approval, the “repricing” of a stock option or stock appreciation right by reducing the exercise price of such award or exchanging such awards for cash, other awards or new stock option or stock appreciation rights at a reduced exercise price. |

| ● | No Automatic Single-TriggerDouble-Trigger Acceleration upon a Change ofin Control. ThereIn the event an Award continues in effect or is no provision for the automatic acceleration of unvested awards uponassumed by an acquirer in connection with a change in control of control. The applicable merger agreement may provide for acceleration of awards and the administrator has discretion to provide for acceleration upon aCompany, such Award would accelerate vesting only if the participant is terminated without cause within twenty-four (24) months following the change of control with a related termination of employment.in control.

|

| | | | ● | Awards Subject to Clawback. All Awards are subject to clawback, forfeiture or recoupment in accordance with any such policy implemented by the Company. | | | | | ● | No Transferability. Awards generally may not be transferred, except by will or the laws of descent and distribution, unless approved by the Board.administrator. |

| | | | ● | No Discounted Options or Stock Appreciation Rights. Stock options and stock appreciation rights may not be granted with exercise prices lower than the fair market value of the underlying shares on the date of the grant. |

| | | | ● | Performance-Based Grants. We align a significant portion of our annual equity awards to employees and non-employee directors with Company performance. |

| | | | ● | Share Limits for Non-Employee Directors. The Sixth Amended 2011 Plan limits the total annual options and stock units granted to non-employee directors to 8% of the total annual option and stock unit refresh grants to employees and consultants, including Named Executive Officers. | | | | | ● | Fungible Share Reserve. To manage dilution, the shares reserved for issuance under the FourthSixth Amended 2011 Plan will be reduced by 1.33 shares for every share issued as a stock grant or pursuant to a stock unit. |

| | | | ● | Burn Rate Commitment. To continue to manage and control the amount of our common stock used for equity compensation, on April 8, 2016,in connection with our 2019 annual meeting of stockholders, our Board adopted a resolution committingcommitted to stay below a 3-year average maximum burn rate for fiscal years 20162019 through 2019, which our stockholders approved on May 31, 2016.2021. This burn rate commitment requires us to limit the number of shares that we grant subject to stock awards each year of the three-year period to no more than an annual average of 7.0% of our weighted average common stock outstanding. Our three-year average burn rate through the end of fiscal year 20162019 was 5.03%6.06%. |